cayman islands tax treaty

See the Other issues section in the Corporate summary for a description of Bilateral Agreements that the Cayman Islands has entered into. Provisional translation October 17 2011.

Cayman Islands And Income Taxes As A Canadian R Personalfinancecanada

For further information on tax treaties refer to the International Tax page of the US.

. Automatic data exchange as part of the European. 6 April 2011 for Income and. The first limb of it but without saying so attempts to deal with the failure of the OECD double tax treaty networks which in concert are the facilitators of the egregious transfer pricing and profit shifting strategies that are the root cause of the EUs problem.

Department of the Treasury. A the term Party means Canada or the Cayman Islands as the context requires. Determining Alien Tax Status.

Its effective in the UK and the Cayman Islands from. CAYMAN FINANCE AUGUST 2019 4 aymans globally responsible Tax Neutral regime is a distinguishing feature among International Financial Centres IFCs many of which are tax treaty. The following is a summary of the work underway to negotiate new DTAs and to update existing agreements.

It started to be effective in the Cayman Islands starting with April 2011 for the corporation tax and for the income and capital gains tax and from December 2010 for other taxes. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries. The Cayman Islands operates a Tax Neutral regime and has no Double Taxation Treaties.

Travers argues that the reforms are a poor attempt at covering up the failures of the OECDs double tax treaty network. Therefore it has no legal mechanism to allow base-shifting. Currently no withholding taxes WHTs are imposed on dividends or payments of principal or interest.

Cross-border economic transactions involving the Tax Neutral jurisdiction of the Cayman Islands do not require tax treaties as there is. An efficient and neutral hub Cayman provides opportunities for many different countries their businesses and their. Expatriate tax return as a US.

Cayman Islands double tax treaties. The competent authorities of the Parties shall provide assistance through exchange of. Ireland has signed comprehensive Double Taxation Agreements DTAs with 76 countries.

On October 14 Tue mutual notification procedures were completed for entry into force of the Agreement between the Government of Japan and the Government of the Cayman Islands for the Exchange of Information for the Purpose of the. 1 April 2011 for Corporation Tax. Department for International Tax Cooperation.

Cayman IslandsUK double tax treaty. Anthony Travers OBE from Travers Thorp Alberga in Cayman Islands analyses the intention of the newly announced G7 initiative which aims to tackle tax abuses by multinationals by ensuring that tax is paid in the jurisdiction in which profits are made. Foreign tax relief.

It has however entered into limited tax treaties with the UK and New Zealand and signed a comprehensive tax treaty with Japan in 2010 see below in addition to several tax. China - Cayman Islands Tax Treaty. Double Tax Treaties in Cayman Islands.

Information that is foreseeably relevant to the. Claiming Tax Treaty Benefits. The Government of the Cayman Islands and the Government of the Peoples Republic of China the Contracting Parties Acknowledging that the Contracting Parties are competent to negotiate and conclude a tax information exchange agreement administration and enforcement of the domestic laws of the.

The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model. As we discussed in our previous blog How the Cayman Islands is an Extender of Value the Cayman Islands tax neutrality model supports the efficient free flow of trade capital investing financing and services around the world. A double tax treaty is a bilateral agreement between two parties for the abolition of double taxation on active and passive income.

Article 1 Object and Scope of this Agreement. At this stage the Cayman Islands tax information exchange network covered four of the seven G-7 states and seventeen of the 30 OECD member states. Duty charged at varying rates depending on the goods is levied on most goods imported into the islands.

In this case the shell corporation earns the companys profits and is subject to the tax laws of the Cayman Islands rather than the United States. The Cayman IslandsUK double taxation arrangement DTA was signed in June 2009 and it entered into force in December 2010. Expat in the Cayman Islands.

The Cayman Islands also had eight bilateral tax information agreements at this time which included recent agreements with the Nordic countries. The Cayman Islands has not concluded any tax treaties. Tax Agreement with the Cayman Islands will enter into force.

Taxpayer all worldwide income is subject to taxation and reporting and for most. Not Cayman Islands tax law. US citizens and green card holders living in Cayman must file a tax.

THE GOVERNMENT OF THE CAYMAN ISLANDS and THE GOVERNMENT OF CANADA desiring to facilitate the exchange of information with respect to taxes have agreed as follows. The Protocol to the existing DTA and Amending. Failure Of Double Tax Treaty Networks.

B the term competent authority means. There also is a tonnage fee for vessels. Foreign tax relief and tax treaties.

Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. I in the case of Canada the Minister of National Revenue or the Ministers authorised representative. Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation.

The Tax Samaritan country guide to Cayman Islands Expat Tax advice is intended to provide a general review of the tax environment of the Cayman Islands and how that will impact your US. Tax services and publications. As the Cayman Islands impose no income tax it has not entered into many double tax agreements and in fact some of these have been signed.

Refer to the Tax Treaty Tables page for a summary of many types of income that may be exempt or subject to a reduced rate of tax. Ii in the case of the Cayman Islands the Tax Information Authority or its authorised representative. Cayman Islands Highlights 2022.

Not having any taxes other than customs duties and stamp duty the Cayman Islands did not until recently enter into any double tax treaties with other countries. Other issues Cayman Islands Corporate - Withholding taxes Last reviewed - 08 December 2021. 73 are in effect.

A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is less than the foreign earned income and housing exclusions discussed above. This is entirely untrue. Other tax credits and incentives.

The agreements cover direct taxes which in the case of Ireland are. The Double Taxation Arrangement entered into force on 20 December 2010.

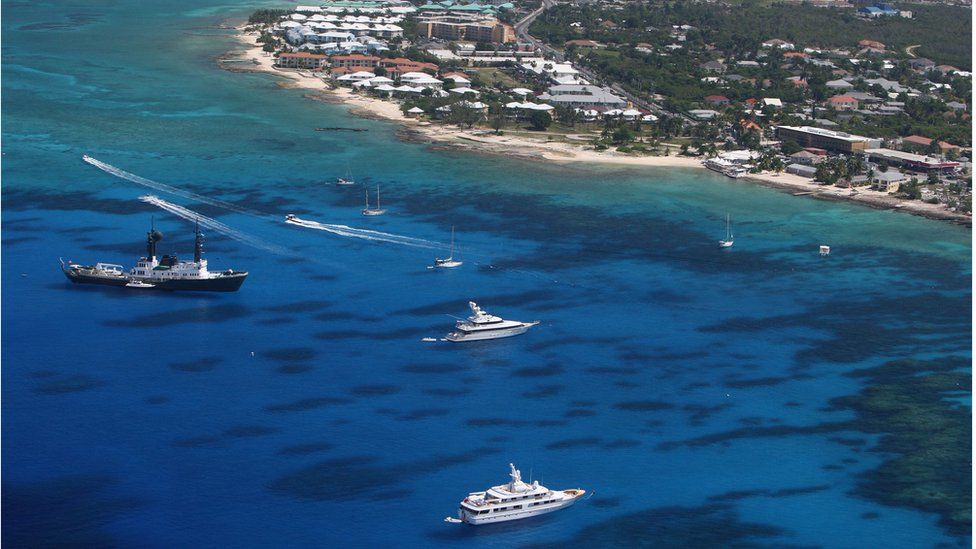

Cayman Islands Profile Bbc News

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

Tiea Between The Cayman Islands The Former Netherlands Antilles To Enter Into Force Orbitax News

Cayman Islands Introduces Beneficial Ownership Register Regime Vistra

Lowtax Global Tax Business Portal Double Tax Treaties Introduction

Lacovia Condominiums Grand Cayman Cayman Islands Grand Cayman Cayman Cayman Islands

Cayman Islands Profile Bbc News

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist Cayman Islands The Guardian

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

How To Open An Offshore Bank Account In The Cayman Islands

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Here Are Some Of The Most Sought After Tax Havens In The World

Move Your Canadian Business To The Cayman Islands

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Invade The Cayman Islands Thestreet

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe